Oct. 15 (Bloomberg) — Federal Reserve Chairman Ben S. Bernanke said the central bank will consider discarding its long- standing aversion to interfering with asset-price bubbles and warned that the banking business may be concentrated in too few companies.

Tag: economics

Bailouts: Understanding Risk in a Networked Economy

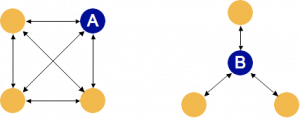

Individual power increases network risk. When the power goes, so does the network.

But, this risk can also mobilize everyone else to buoy up the network by supporting the powerful (AIG rescue) or group cooperation (bailout lobbying). When a power fails, there will be painful redistribution of wealth (Lehman Brothers) and the market as new relationships are established. The market redistribution remains to be seen, but JPMorgan’s buying up relationships (the network) left and right.

Recommendations to the survivors. It’s easier to buy existing relationships through M&A than to create them from scratch, so think specific geographies and buy local; that’s where you’ll find the majority of relationships. For all those new customers you acquire reach out to them early and often. Build the relationships that kept them with your acquiring company.

Network risk is inherent to trading, and traders will never willingly open their books. The bulk of a trader’s value is in his judgment, not the actual trading. If you knew what they were buying and selling, you could duplicate their portfolio without paying their fees. But, there’s an opportunity for a new Moody’s: grade trading funds on network risk.